Philanthropy through Tax Credits

50% State Tax Credits For Individuals and Businesses

The Missouri Development Finance Board (MDFB) through the Tax Credit for Contributions program has awarded $250,000 in tax credits to Texas County Memorial Hospital (TCMH). Any individual, business, estate, trust, orcorporation that files taxes in the state of Missouri is eligible to receive the tax credits by making a donation on behalf of the Texas County Memorial Hospital to MDFB. Tax credits will be used to raise $500,000 for Care For Your Future, which provides funding for construction of a new FEMA approved tornado safe room and community room to be built on the hospital campus.

The tax credits have a five-year carry-forward provision. Furthermore, they are sellable and transferable, but must sell for no less than 75% or more than 100%. Sales of tax credits are also taxable income. Tax credits are limited, and are awarded on a first-come, first-served basis.

The tax credits have a five-year carry-forward provision. Furthermore, they are sellable and transferable, but must sell for no less than 75% or more than 100%. Sales of tax credits are also taxable income. Tax credits are limited, and are awarded on a first-come, first-served basis.

How the MDFB Tax Credit for Contribution Program Works

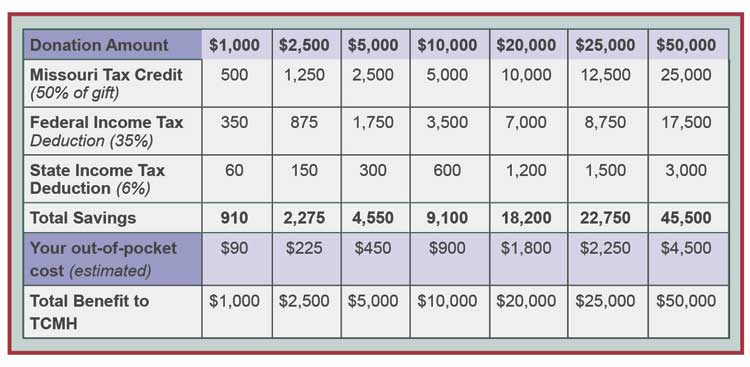

The MDFB Tax Credit Program is simple. Rather than awarding grants to specific projects, MDFB approves a project and then processes tax credits for eligible donors (those who file MO taxes) that fund the project. Tax credits are issued as coupons that donors redeem when they file Missouri tax returns, and are equal to 50% of the value of most contributions.This enables you, the donor, to help finance local projects with money you would otherwise owe on your Missouri taxes!

*Example: Calculated based on 35% tax bracket

Tax credits are available on a first-come, first-served basis, so claim yours soon!

If you have any questions or would like to arrange a visit to discuss the project and tax credits please contact Jay Gentry at jgentry@tcmh.org or (417) 967-1377 or 1-866-967-3311 Ext. 4202